Solar VAT Reduction 2023

Written by: Michael Malone

Published: August 9, 2023

Last updated: October 9, 2025

Reading time: 2 mins

The price of installing a solar panel system has reduced significantly for Irish households over the past decade, with grants and incentives being introduced to accelerate the country’s transition to green energy.

Planning permission has been removed for the vast majority of homeowners who wish to go solar, and SEAI grants of up to €2,100 are available to reduce the initial solar panel installation costs.

And from 1 May 2023, the rate of VAT on solar installations was reduced to 0% — down from the previous rate of 13.5%.

This reduction in the rate of value added tax on solar panels by the government was in response to high energy prices and challenges related to the cost of living in Ireland.

The Department of the Environment, Climate and Communications estimated that a 0% VAT rate would reduce the average cost of the supply and installation of solar panel systems from €9,000 to €8,000.

This means that since the measure was introduced, people in Ireland installing solar panels will pay around 11.5% less than they would have previously.

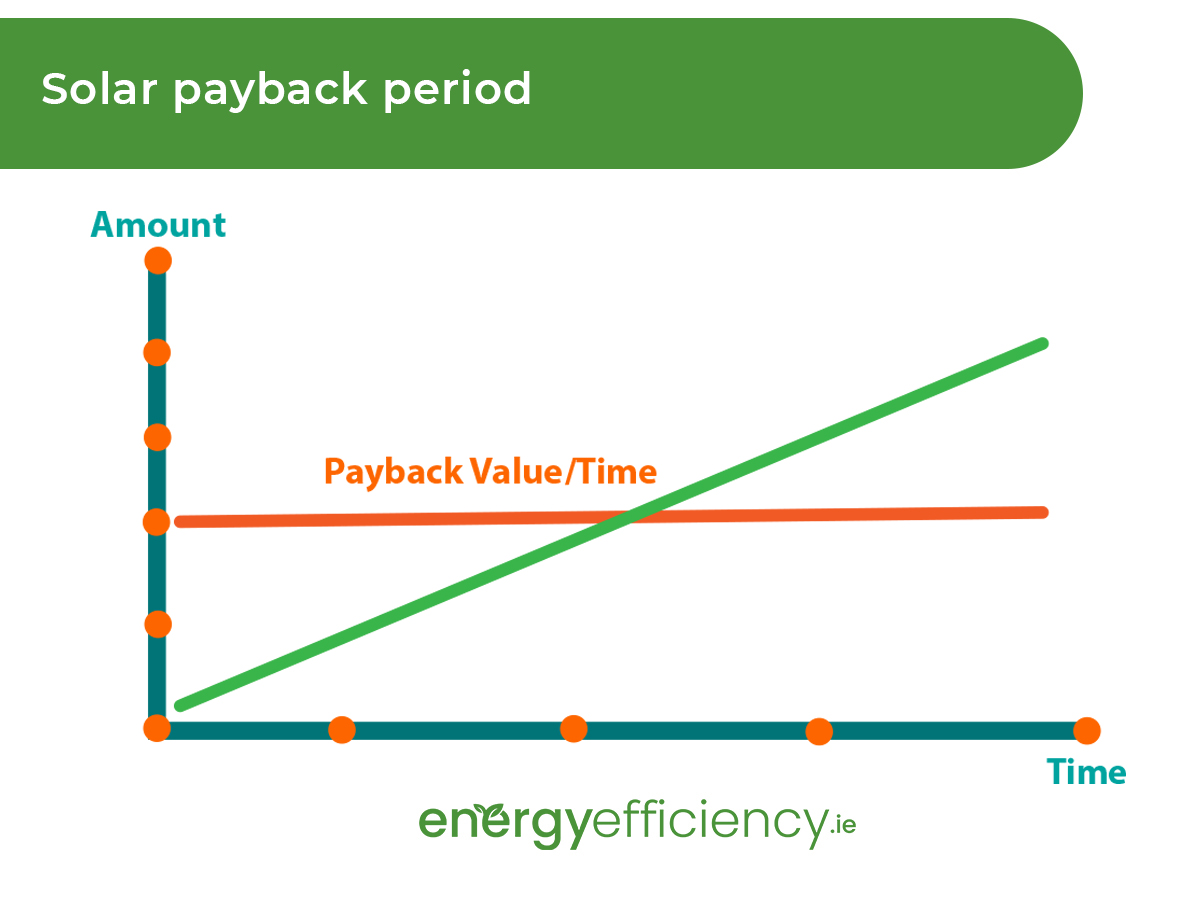

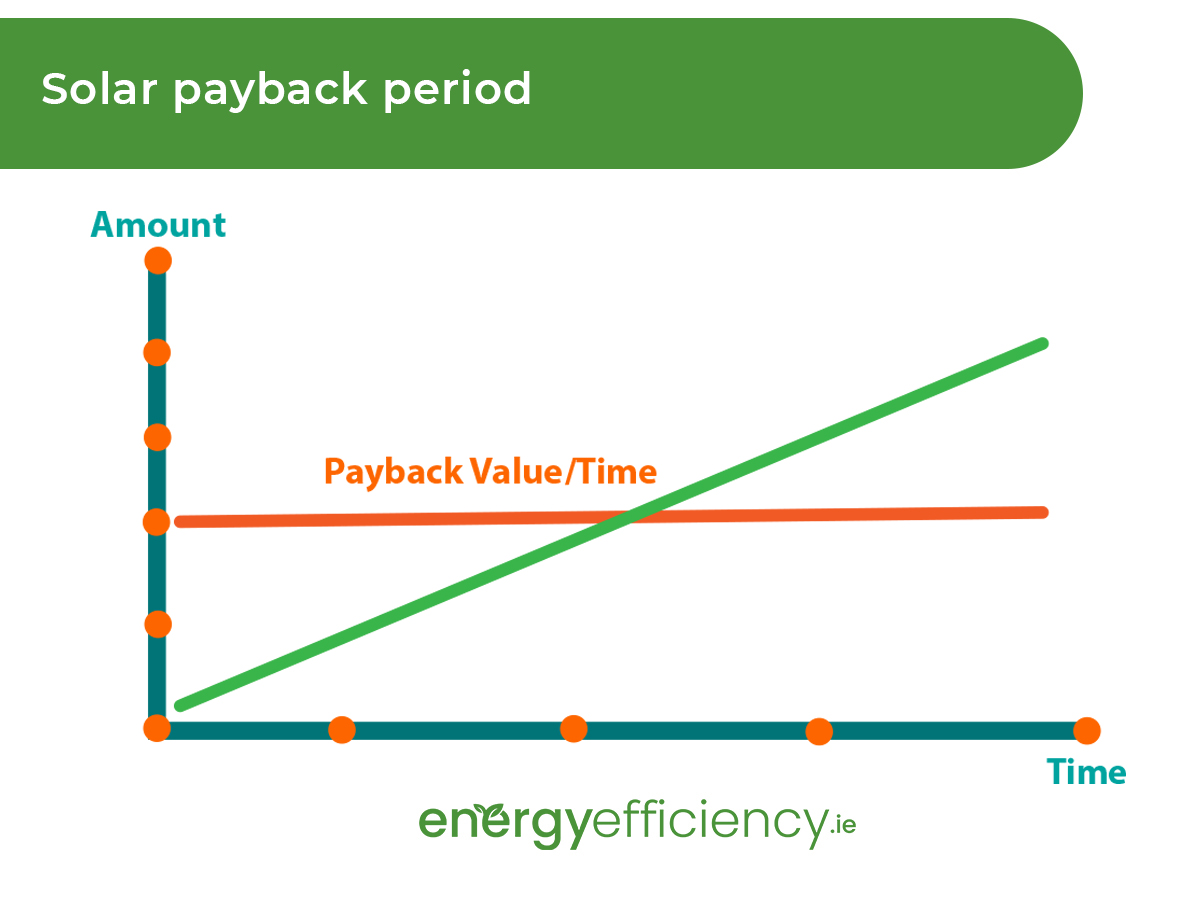

The government estimated that the change will help support households reducing their electricity bills, and at 32 cent per KWh, it reduces the payback period for solar PV installations from 7 to 6.2 years.

Although the new VAT rate was brought in to help deal with the cost of living crisis and high energy bills, the change is permanent.

However, it must be noted that the new VAT rate on PV solar panels applies only to private properties – i.e. houses and apartments, as well as caravans or mobile homes that are attached to the ground in such a way that they are unable to move.

While the new rate applies only to private dwellings, the solar PV panels themselves are not required to be attached to the actual building. Ground mounted or pole mounted systems on the grounds of a private residence are also exempt from VAT.

So where does the new VAT rate not apply? Basically, everywhere which is not considered a private dwelling.

The zero VAT rate on solar panels can not be enjoyed by those wishing to install panels on commercial or industrial buildings, farm buildings, hotels etc.

For mixed use buildings, for example, if you live in one half of your home, but the other half is a B&B, then you will pay 0% VAT on half of the installation.

And it’s not just the solar PV panels themselves that have 0% VAT, but the whole solar system, including controllers, batteries and labour.

The one exception is EV chargers, which retain the 13.5% VAT rate.

Minister for the Environment, Eamon Ryan TD, said that the move to 0% VAT on PV solar panels is another step on the journey to cheaper, renewable energy.

He highlighted the removal of planning permission for installations as well as the Micro-generation Support Scheme, which he said is continuing to prove very successful.

The Minister also said that while the change will help Irish consumers, it is also of benefit to the environment.

Over 50,000 homes have solar panels in Ireland, with 17,000 solar installations connecting to the grid taking place in 2022.

Solar VAT Reduction 2023

Published: August 9, 2023

Last updated: October 9, 2025

Written by: Michael Malone

Reading time: 2mins

The price of installing a solar panel system has reduced significantly for Irish households over the past decade, with grants and incentives being introduced to accelerate the country’s transition to green energy.

Planning permission has been removed for the vast majority of homeowners who wish to go solar, and SEAI grants of up to €2,100 are available to reduce the initial solar panel installation costs.

And from 1 May 2023, the rate of VAT on solar installations was reduced to 0% — down from the previous rate of 13.5%.

This reduction in the rate of value added tax on solar panels by the government was in response to high energy prices and challenges related to the cost of living in Ireland.

The Department of the Environment, Climate and Communications estimated that a 0% VAT rate would reduce the average cost of the supply and installation of solar panel systems from €9,000 to €8,000.

This means that since the measure was introduced, people in Ireland installing solar panels will pay around 11.5% less than they would have previously.

The government estimated that the change will help support households reducing their electricity bills, and at 32 cent per KWh, it reduces the payback period for solar PV installations from 7 to 6.2 years.

Although the new VAT rate was brought in to help deal with the cost of living crisis and high energy bills, the change is permanent.

However, it must be noted that the new VAT rate on PV solar panels applies only to private properties – i.e. houses and apartments, as well as caravans or mobile homes that are attached to the ground in such a way that they are unable to move.

While the new rate applies only to private dwellings, the solar PV panels themselves are not required to be attached to the actual building. Ground mounted or pole mounted systems on the grounds of a private residence are also exempt from VAT.

So where does the new VAT rate not apply? Basically, everywhere which is not considered a private dwelling.

The zero VAT rate on solar panels can not be enjoyed by those wishing to install panels on commercial or industrial buildings, farm buildings, hotels etc.

For mixed use buildings, for example, if you live in one half of your home, but the other half is a B&B, then you will pay 0% VAT on half of the installation.

And it’s not just the solar PV panels themselves that have 0% VAT, but the whole solar system, including controllers, batteries and labour.

The one exception is EV chargers, which retain the 13.5% VAT rate.

Minister for the Environment, Eamon Ryan TD, said that the move to 0% VAT on PV solar panels is another step on the journey to cheaper, renewable energy.

He highlighted the removal of planning permission for installations as well as the Micro-generation Support Scheme, which he said is continuing to prove very successful.

The Minister also said that while the change will help Irish consumers, it is also of benefit to the environment.

Over 50,000 homes have solar panels in Ireland, with 17,000 solar installations connecting to the grid taking place in 2022.

Solar Energy Saves Households Thousands in Electricity Costs

Take our 2-minute questionnaire and find affordable solar options to suit your budget and lifestyle.