How Solar Panels Affect Home Insurance

Written by

Michael Malone

Last edited

27/07/2024

Solar panels are a fantastic long-term investment, as they are environmentally friendly, they slash energy bills and can add value to the price of your house.

The initial investment in solar panels may seem costly, with a PV system in Ireland typically ranging from €4,000 to €12,000, with a number of grants available.

While there are countless benefits to solar energy, it is important to take into consideration other factors which could influence the true cost of solar panels.

One thing that may be overlooked is what having an array of PV panels means for home insurance. In this guide, we’ll explore what you need to know regarding solar panels and home insurance.

Table of content

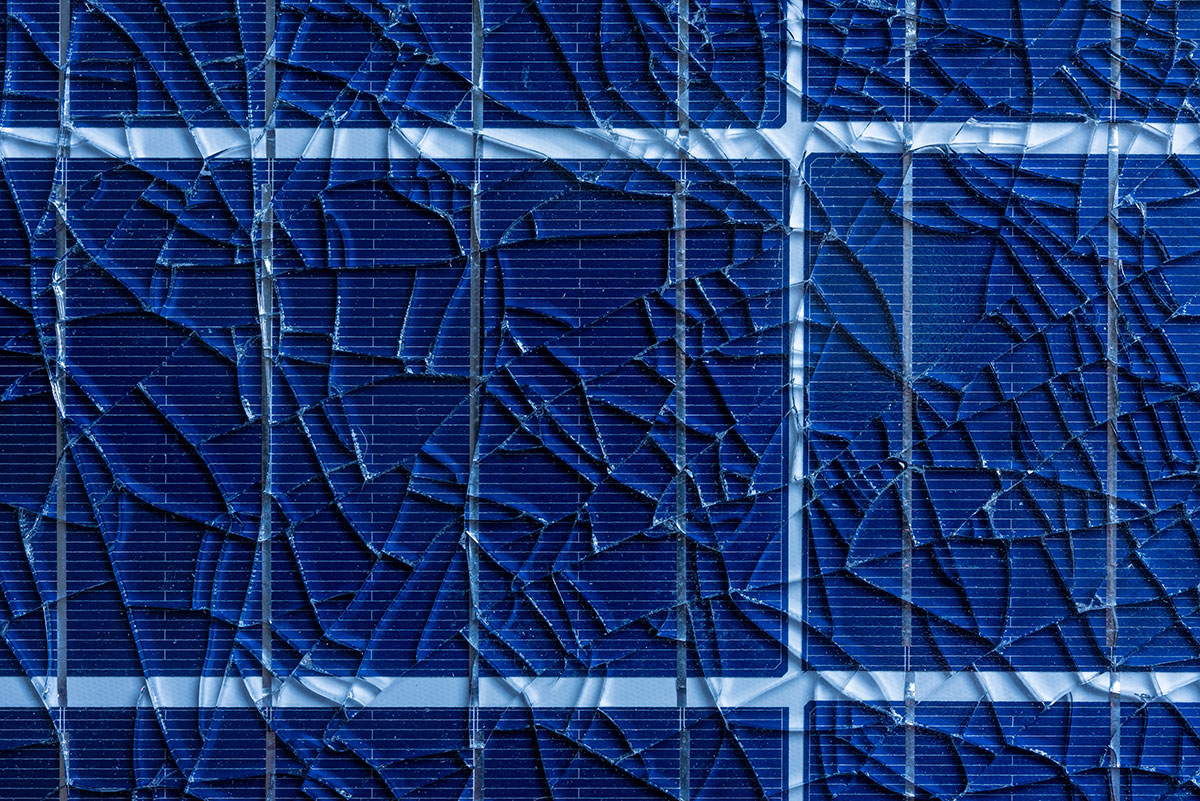

Can Solar Panels Break?

Solar panels require very little maintenance over the years, and occasional servicing and cleaning is all you need to worry about for the most part.

They are also sturdy structures, designed to endure all kinds of weather conditions from heavy rain to snow.

In short, solar panels do not break easily. However, that doesn’t mean that it never happens.

While it is rare, solar panels can be damaged by weather conditions like hail or debris from gale force winds.

Damage caused by flying tree branches during a storm wouldn’t be surprising – however, solar panels are more likely to be damaged by smaller objects, such as leaves, dirt or twigs.

These can be dragged across the solar panel, causing tiny scratches which worsen gradually over time.

For this reason it is recommended that you have your panels serviced and cleaned regularly.

How Home Insurance is Affected by Solar Panels

Luckily, many home insurance policies now cover solar panel installations as standard, with providers considering them to be a permanent fixture, or part of the fabric of the home.

This essentially means that your home insurance policy pricing will stay the same, and you don’t have to take out a separate policy to insure them.

It might be wise to ensure you have sufficient cover in case they need to be replaced, despite this being unlikely.

Solar Panels Add Value to your Home

Solar panels can add value to your home as they increase the property’s energy efficiency while being environmentally friendly.

The increased value will be determined by a range of factors, including the annual energy output your PV system produces.

If your house leaps from one price range to the next, it could impact your premium with certain home insurance providers.

But again, the benefits outweigh the negatives, and should weigh up any increases with lower energy bills over the lifespan of your solar panel system, and its positive effect on the value of your home.

Is home insurance and building insurance the same?

Home insurance can refer to buildings or contents insurance, or combined policies which cater for both the home’s contents and structure.

Buildings insurance essentially covers the physical structure of your home as well as any fixtures and fittings while contents insurance covers the items within your home, which can include anything from furniture to clothing and jewellery.

Are all types of solar panels covered by my home insurance?

Most rooftop solar systems which are attached to your home should be covered by your home insurance.

Ground mounted or pole mounted solar panel structures on the other hand will not be covered, as they are not physically attached to your home.

Roof mounted solar panels which should be covered include:

These solar panel systems should be covered for damage from fire, falling trees and weather, as well as theft (which is also unlikely).

But again, it is best to check with your provider to determine exactly what they cover.

Alerting your Insurance Provider

When installing solar panels on your roof, or making any other big changes to your home, you should alert your home insurance provider to ensure you are adequately covered.

This applies to major changes to the structure of the property such as renovations and extensions, as well as installing solar panels.

Talking to your insurance broker early in the installation process is recommended, as they will be able to give more detailed answers to any questions about the impact of solar panels on the cost of home insurance.

FAQs

Learn more about solar panels today

Learn more about why thousands of Irish homes are switching to solar panels for their home energy.

Take our free online assessment to speak with an expert and find out how much you could save today!

Author:

Michael Malone

SOLAR ENERGY EDITOR

Michael Malone is Solar Energy Editor at Energy Efficiency Ireland. He is committed to highlighting the benefits of solar PV for people across the island of Ireland, and is eager to clear up some misconceptions which linger among the Irish public regarding solar energy.

Author:

Michael Malone

Solar Energy Editor

Michael Malone is Solar Energy Editor at Energy Efficiency Ireland. He is committed to highlighting the benefits of solar PV for people across the island of Ireland, and is eager to clear up some misconceptions which linger among the Irish public regarding solar energy.

How Solar Panels Affect Home Insurance

Written by

Aimee Whelan

Last edited

27/07/2024

Solar panels are a fantastic long-term investment, as they are environmentally friendly, they slash energy bills and can add value to the price of your house.

The initial investment in solar panels may seem costly, with a PV system in Ireland typically ranging from €4,000 to €12,000, with a number of grants available.

While there are countless benefits to solar energy, it is important to take into consideration other factors which could influence the true cost of solar panels.

One thing that may be overlooked is what having an array of PV panels means for home insurance. In this guide, we’ll explore what you need to know regarding solar panels and home insurance.

Table of content

Can Solar Panels Break?

Solar panels require very little maintenance over the years, and occasional servicing and cleaning is all you need to worry about for the most part.

They are also sturdy structures, designed to endure all kinds of weather conditions from heavy rain to snow.

In short, solar panels do not break easily. However, that doesn’t mean that it never happens.

While it is rare, solar panels can be damaged by weather conditions like hail or debris from gale force winds.

Damage caused by flying tree branches during a storm wouldn’t be surprising – however, solar panels are more likely to be damaged by smaller objects, such as leaves, dirt or twigs.

These can be dragged across the solar panel, causing tiny scratches which worsen gradually over time.

For this reason it is recommended that you have your panels serviced and cleaned regularly.

How Home Insurance is Affected by Solar Panels

Luckily, many home insurance policies now cover solar panel installations as standard, with providers considering them to be a permanent fixture, or part of the fabric of the home.

This essentially means that your home insurance policy pricing will stay the same, and you don’t have to take out a separate policy to insure them.

It might be wise to ensure you have sufficient cover in case they need to be replaced, despite this being unlikely.

Solar Panels Add Value to your Home

Solar panels can add value to your home as they increase the property’s energy efficiency while being environmentally friendly.

The increased value will be determined by a range of factors, including the annual energy output your PV system produces.

If your house leaps from one price range to the next, it could impact your premium with certain home insurance providers.

But again, the benefits outweigh the negatives, and should weigh up any increases with lower energy bills over the lifespan of your solar panel system, and its positive effect on the value of your home.

Is home insurance and building insurance the same?

Home insurance can refer to buildings or contents insurance, or combined policies which cater for both the home’s contents and structure.

Buildings insurance essentially covers the physical structure of your home as well as any fixtures and fittings while contents insurance covers the items within your home, which can include anything from furniture to clothing and jewellery.

Are all types of solar panels covered by my home insurance?

Most rooftop solar systems which are attached to your home should be covered by your home insurance.

Ground mounted or pole mounted solar panel structures on the other hand will not be covered, as they are not physically attached to your home.

Roof mounted solar panels which should be covered include:

These solar panel systems should be covered for damage from fire, falling trees and weather, as well as theft (which is also unlikely).

But again, it is best to check with your provider to determine exactly what they cover.

Alerting your Insurance Provider

When installing solar panels on your roof, or making any other big changes to your home, you should alert your home insurance provider to ensure you are adequately covered.

This applies to major changes to the structure of the property such as renovations and extensions, as well as installing solar panels.

Talking to your insurance broker early in the installation process is recommended, as they will be able to give more detailed answers to any questions about the impact of solar panels on the cost of home insurance.

FAQs

Learn more about solar panels today

Learn more about why thousands of Irish homes are switching to solar panels for their home energy.

Take our free online assessment to speak with an expert and find out how much you could save today!

Author:

Michael Malone

SOLAR ENERGY EDITOR

Michael Malone is Solar Energy Editor at Energy Efficiency Ireland. He is committed to highlighting the benefits of solar PV for people across the island of Ireland, and is eager to clear up some misconceptions which linger among the Irish public regarding solar energy.

Author:

Michael Malone

Solar Energy Editor

Michael Malone is Solar Energy Editor at Energy Efficiency Ireland. He is committed to highlighting the benefits of solar PV for people across the island of Ireland, and is eager to clear up some misconceptions which linger among the Irish public regarding solar energy.